Getting My Real Estate Reno Nv To Work

Getting My Real Estate Reno Nv To Work

Blog Article

All About Real Estate Reno Nv

Table of ContentsThe Ultimate Guide To Real Estate Reno NvThe Real Estate Reno Nv Statements7 Simple Techniques For Real Estate Reno NvThe Best Strategy To Use For Real Estate Reno Nv

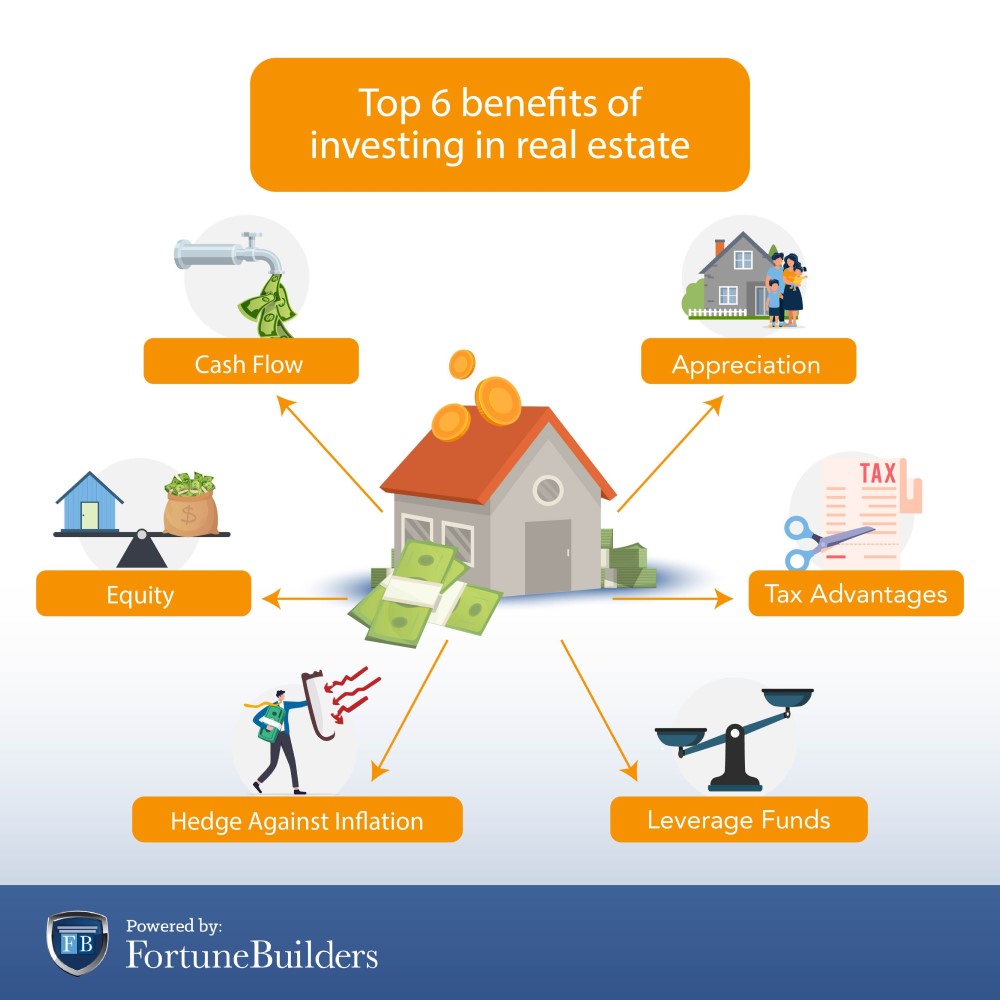

That may appear costly in a world where ETFs and shared funds might bill just zero percent for building a diversified profile of stocks or bonds. While platforms might veterinarian their investments, you'll have to do the same, and that indicates you'll require the skills to evaluate the possibility.Caret Down Capital gratitude, reward or interest repayments. Like all investments, genuine estate has its pros and disadvantages. Right here are a few of the most crucial to maintain in mind as you weigh whether or not to purchase actual estate. Long-term recognition while you stay in the home Potential bush against inflation Leveraged returns on your financial investment Easy income from rental fees or with REITs Tax advantages, consisting of interest reductions, tax-free capital gains and devaluation write-offs Repaired long-term funding offered Appreciation is not assured, especially in financially depressed locations Home prices might fall with higher interest prices A leveraged investment indicates your down repayment goes to risk Might require considerable time and money to handle your own properties Owe a set home mortgage payment on a monthly basis, even if your renter does not pay you Reduced liquidity for real building, and high commissions While property does use many advantages, specifically tax obligation advantages, it doesn't come without considerable drawbacks, specifically, high payments to leave the market.

Or would certainly you like to evaluate bargains or financial investments such as REITs or those on an online system? Knowledge and abilities While lots of financiers can discover on the task, do you have special skills that make you better-suited to one kind of investment than an additional? The tax advantages on genuine estate differ commonly, depending on just how you invest, however spending in real estate can provide some large tax obligation advantages.

Getting The Real Estate Reno Nv To Work

REITs use an attractive tax account you will not sustain any kind of capital gains taxes until you sell shares, and you can hold shares actually for decades to prevent the tax man. As a matter of fact, you can pass the shares on your successors and they will not owe any kind of tax obligations on your gains.

Real estate can be an appealing financial investment, however financiers desire to be certain to match their type of investment with their determination and capability to manage it, including time commitments. If you're looking to create revenue throughout retired life, realty investing can be one way to do that.

There are numerous benefits to purchasing realty. Regular earnings flow, strong returns, tax obligation benefits, diversification with well-chosen assets, and the capability to take advantage of riches via realty are all benefits that financiers may take pleasure in. Right here, we explore the various advantages of purchasing actual estate in India.

Indicators on Real Estate Reno Nv You Should Know

Realty has a tendency to value in worth in time, so if you make a clever investment, you can benefit when it comes time to market. Over time, leas additionally tend to boost, which could enhance cash money flow. Leas raise when economic situations increase because there is more need genuine estate, which raises funding worths.

Among one of the most attractive sources of passive income is rental profits. One of the simplest methods try this website to maintain a consistent earnings after retired life is to do have a peek at this site this. If you are still functioning, you might increase your rental revenue by investing it following your financial objectives. There are various tax benefits to property investing.

It will considerably minimize taxable revenue while decreasing the expense of real estate investing. Tax obligation reductions are given for a range of expenses, such as business expenses, cash circulation from various other possessions, and mortgage passion.

Actual estate's link to the other main asset groups is fragile, sometimes also unfavorable. Property might therefore reduce volatility and boost return on risk when it is included in a profile of various properties. Compared to various other possessions like the stock exchange, gold, cryptocurrencies, and banks, buying genuine estate can be significantly much safer.

Real Estate Reno Nv Fundamentals Explained

The securities market is continually changing. The property sector has actually grown over the past numerous years as a result of the implementation of RERA, reduced home mortgage passion prices, and other aspects. Real Estate Reno NV. The interest rates on financial institution cost savings accounts, on the other hand, are low, specifically when compared to the increasing inflation

Report this page